Embedded Banking

Add the Power of Banking to Any Digital Experience

Embedded Banking allows non-bank partners to add financial services to their digital experiences through a partnership with Apiture and a financial institution

Custom Configurations

Each embeddable component supports flexible configuration, enabling non-financial partners to seamlessly integrate banking services into their experience while maintaining brand consistency.

Exceed Your Users’ Expectations

Release new functionality and be an innovator in the market on your own timeline. Our banking tools help your users manage and grow their financial portfolios without ever leaving your experience.

Unlock New Revenue Streams

Offer additional value to your users with digital account opening, transactional banking services such as transfers and payments, and more. High value financial services help generate revenue for your partner financial institution as well.

How It Works

Engage and Grow Through Partnerships

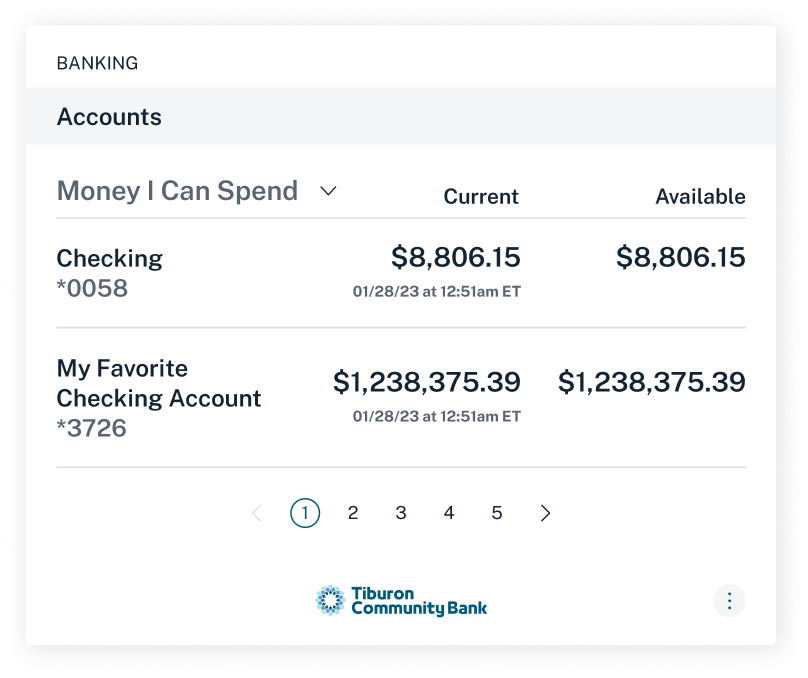

Embedded banking allows financial institutions to offer banking services through non-financial partner companies. Users can therefore seamlessly access banking services from within the partner’s website or app. For instance, a college may have embedded banking services inside their student portal, where a student can easily view their account balances while making tuition payments directly from within the portal.

Embedded financial services are easily implemented by the financial institution’s partners using Apiture’s embeddable components, SDKs, and APIs. For more information on how to offer embedded banking, view our documentation.

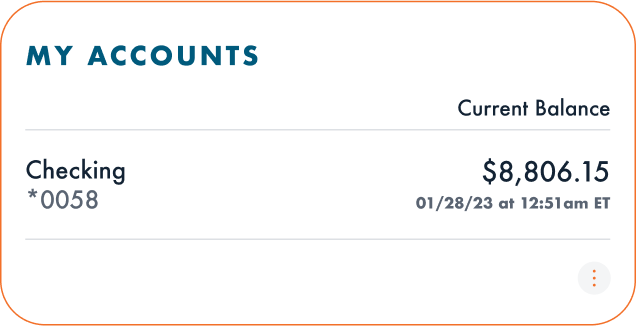

Custom UI Options

Embedded banking partners can choose from a variety of flexible configuration options to customize Apiture’s embeddable components. These configurations enable banking services to fit the specific needs of many different applications and end user experiences.

- Component size and style

- Font family and accent colors

- Hide or display specific features

- Titles and menu links

For Financial Institutions

Embedded banking is a powerful new strategy that can fundamentally change how financial institutions serve existing customers and develop new relationships. This strategy enables financial institutions to meet their customers where they are today with the right solution at the right time.

For Embedded Banking Partners

Give users the financial information they need to make good decisions:

- View accounts and balances

- View transaction history

- Make transfers

Next up

Speak with an expert

Our sales team will walk you through our suite of tools and answer any questions you have

Curious about our company?

We also offer the Apiture Digital Banking Platform, which can stand up a new online & mobile bank in only 3 to 6 months. To learn more about this solution trusted by over 500 banks & credit unions, visit our website.